Newsroom

In the News

How Albemarle’s Biocides Help Protect Water Systems and the Food Supply Chain

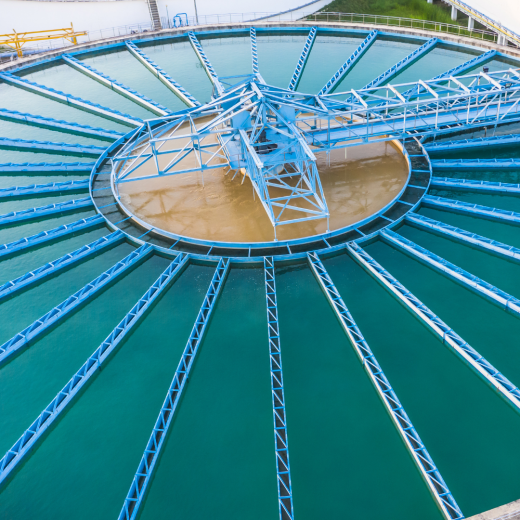

On any given day, millions of gallons of water circulate through cooling towers, industrial systems and power plants across the country. At the same time, food processing plants operate around the clock to help ensure that meat products are safe when they reach the grocery stores. Hidden behind all these systems is a quiet line of defense: biocides. And according to Albemarle experts, they're far more essential to daily life than most people realize.

MEDIA FACT SHEET

From Resources - Mine and Brine - To Market

Download our media fact sheet to learn the role Albemarle plays in the extraction, conversion and processing of lithium and bromine.

Press & Media Contact

For press & media inquiries, please contact our Media Relations team - for all other inquiries please go through the Contact Us page.